The accounting industry isn’t just changing—it’s accelerating. Technology is automating the routine. Clients want proactive guidance, not transactional deliverables. And firm leaders feel growing pressure to scale revenue, talent, and capabilities.

So what does meaningful growth look like for your accounting firm in 2026? It goes far beyond adding clients or increasing billings. Today, growth happens at the intersection of culture, leadership, and strategic partnerships. From succession planning to financial advisory, there are a few ways to optimize your business going forward. Here are five things to consider as you move into the new year.

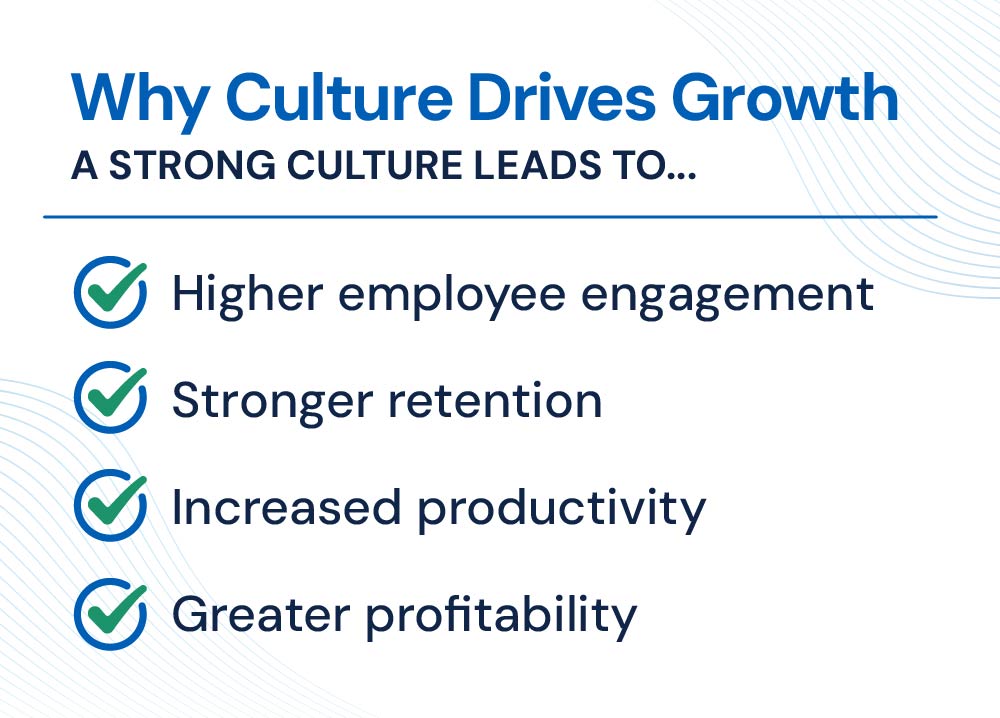

In the past, “culture” was an afterthought. Something you focused on when all other boxes had been checked. Now, culture is at the forefront, driving profitability, impacting employee satisfaction, and decreasing turnover. Firms with a positive culture and high employee engagement see greater productivity, stronger retention and increased profitability. If you’re focused on growth, you should also be focused on building an intentional culture where team members feel valued, included and aligned with your mission. Culture doesn’t change overnight. But small steps can make a difference in time. Here are a few ways to impact your culture:

A quick tip. Take a look at your employee value proposition and ask yourself:

One of the most significant risks facing accounting firms today is lack of succession planning. In many firms, the majority of business and client loyalty sits with top leadership. And as those leaders approach retirement, the question becomes who takes over and are they prepared?

Succession planning isn’t just about eventual ownership transition. It’s about providing peace of mind for owners and employees alike as change becomes inevitable. Below are a few things you can do to help make succession seamless.

You can start thinking about succession planning with a few quick questions. Ask yourself and your team:

At SSC, we work with firms on their succession planning, helping them protect their assets and ensure a smooth transition when the time comes. We can help with succession planning and exit strategy, business valuation and optimization, as well as ESOP advisory and service planning. Give us a call and start planning today to protect your business tomorrow.

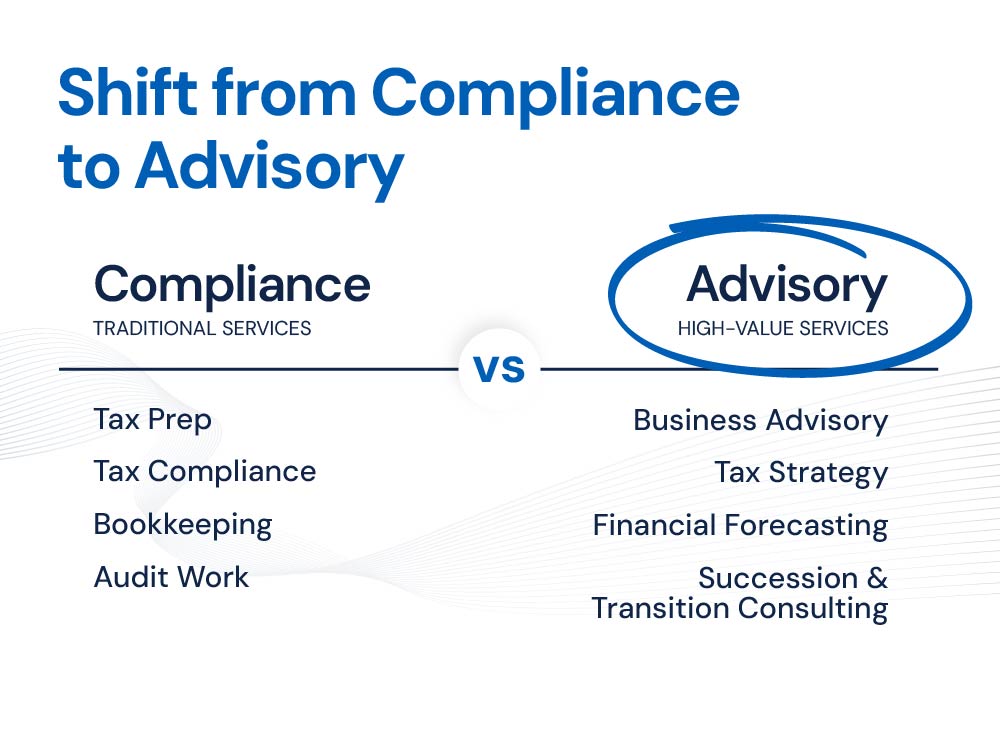

Compliance services such as tax prep, tax compliance, bookkeeping, and audit work will always be the foundation of our industry. But offering these services alone is no longer enough to position your firm for growth in the years ahead. Technology continues to automate many tasks making it difficult to compete on price or speed. Where your firm could see greater growth in the new year is by offering financial advisory services. Financial advisory services help clients make informed decisions, build stronger businesses, and gain clarity about the future.

Clients are looking for partnership and a trusted advisor to offer

financial strategy that aligns with their goals. Advisory services you might consider include:

This shift means developing deeper relationships with your clients beyond the transaction. Financial advisory helps you position your firm for growth in the year ahead, unlocking new opportunities with your clients.

At SSC, we’re dedicated to understanding our clients long term goals and helping set them up for success. From business valuation to forecasting, SSC offers advisory services to support our clients on a deeper level.

If your firm is ready to grow its advisory services but needs additional capacity or support, we’re well positioned to partner with you and help extend your reach. Take the first step today and learn more about the SSC difference.

There is a difference between standard client service and designing a great client experience. Today’s clients want clarity, responsiveness, insights and proactive communication. Growth-focused firms are mapping their client journey from onboarding to ongoing relationship and asking:

This might look like standardizing onboarding touchpoints, scheduling proactive planning meetings or being intentional about education and visibility. Clients who feel understood and supported stay longer, refer more, and are more likely to trust you for advisory services. If you are interested in diving deeper into your client’s experience, consider asking for feedback from your current client base. Understand where you are falling short and what clients like about your service. Then, you can make an informed decision on what stays and what needs to change.

Growth does not always mean building everything internally. For many firm owners, the most strategic move is finding the right partner to help you achieve your goals. The right partner can help you expand service offerings, accelerate advisory growth and improve operational support.

From ESOP advisory services to tax prep, alongside our wealth management and financial planning services through our new partnership with Merit Financial Advisors, SSC gives you a competitive advantage. We offer sharp strategy and real solutions, working with businesses to expand their offerings and provide full-service support to their clients.

Here are a few ways SSC works with businesses:

Growth is no longer about volume alone. It’s about building something sustainable, human-centered, and forward-looking. The accounting firms that thrive in 2026 will be the firms who:

At SSC, we want to be your partner for growth, committed to helping firms and clients look to the future. Whether you want to expand your advisory services, get strategic about succession planning, or commit to building the culture of your organization, SSC is here to help you take command of your business in the new year. Reach out today, and let’s get started.

“SSC CPAs + Advisors” and “SSC” are the brand names under which SSC Advisors, Inc. and SSC CPAs, PA provide professional services. SSC Advisors, Inc. and SSC CPAs, PA practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. SSC CPAs, PA is a licensed independent CPA firm that provides attest services to its clients, and SSC Advisors, Inc. entities provide tax, advisory, and business consulting services to their clients. SSC Advisors, Inc. is not a licensed CPA firm. Our use of the terms “our firm” and “we” and “us” and terms of similar import, denote the alternative practice structure conducted by SSC Advisors, Inc. and SSC CPAs, PA. Advisory services provided through Merit Financial Group, LLC. Merit Financial Group, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission.