If you’re scrambling in March to figure out what you owe in April, you’ve already lost. Successful business owners don’t react to taxes—they own them. The game is played before the year ends, when smart businesses strategize, position themselves for the long term and sidestep nasty surprises.

Nothing eats into your cash flow faster than an unexpected tax bill. If you’re already managing tight budgets and employee turnover, unplanned liabilities can destabilize your finances and force tough decisions that can undermine long-term growth. Taxes are part of your business’s ecosystem. Ignoring them until it’s too late is like carrying around a ticking time bomb.

Reid Hash, Director of Tax at SSC, nails it:

“When a business owner has to write a check for income taxes in March or April, it shouldn’t be a surprise. They should have been told about it by at least the fourth quarter of the previous year. That is one of the main goals of year-end planning meetings with your CPA.”

For business leaders, particularly those in tightly controlled environments, planning ahead means securing financial stability. Whether you’re leading a small manufacturing company or large professional groups, proactive tax planning is key to protecting your bottom line and ensuring long-term success—especially when budgets are tight and resources stretched thin.

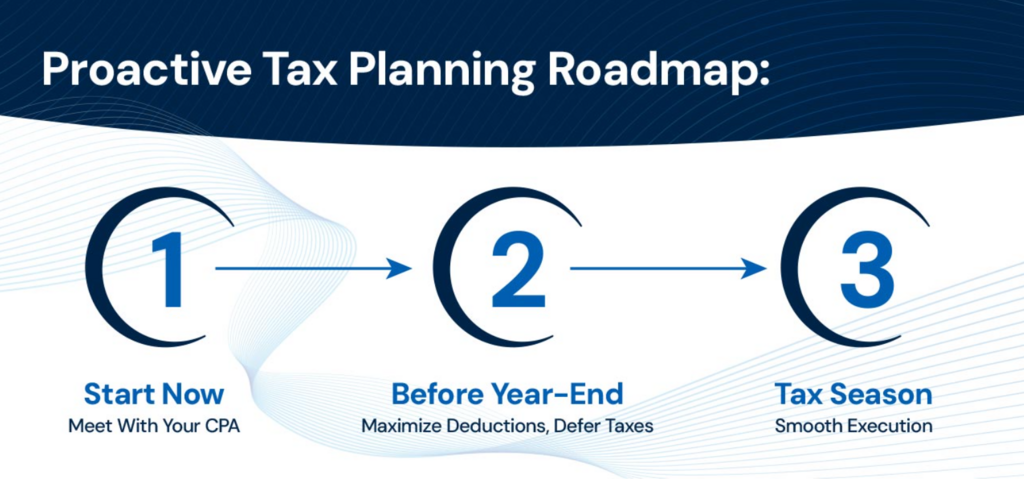

Proactive tax planning means knowing what’s coming down the pipeline:

When you’re operating on a smaller budget and need your team to perform at a high level, every dollar counts. And if you’re managing complex cash flow issues, you can’t afford to waste money on avoidable tax issues. Proactive planning positions you for success with a clearer picture of your financial future.

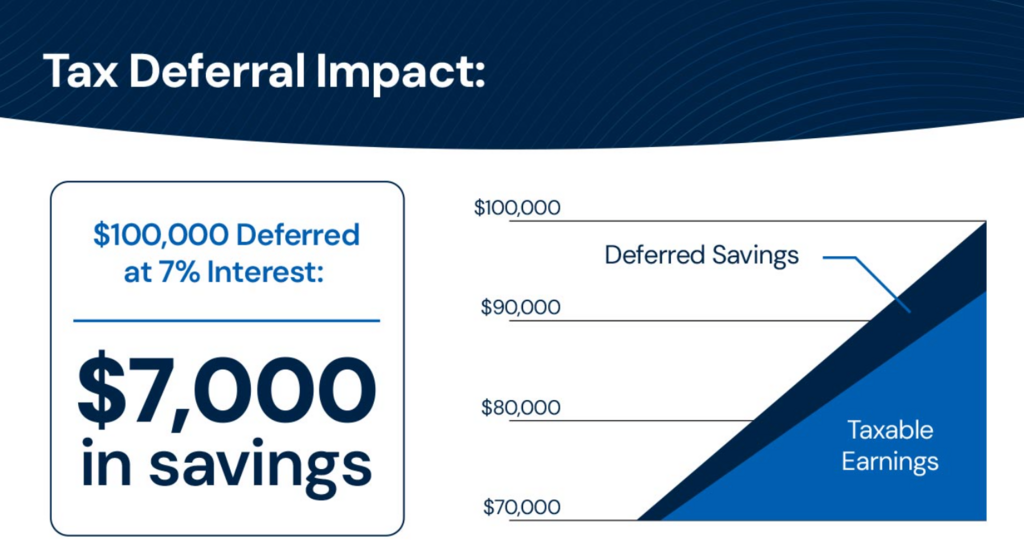

A little foresight goes a long way. Deferring taxes isn’t about avoiding them—it’s about buying yourself breathing room to grow. For instance, deferring $100,000 in taxes at a 7% borrowing rate saves you $7,000 in interest. That’s just the tip of the iceberg, but over time, these savings add up. And for businesses balancing project work with staffing needs, freeing up cash for day-to-day operations is crucial. This breathing room allows you to reinvest in talent, expand, and streamline operations without sacrificing financial security.

Avoiding sudden spikes in taxable income helps maintain financial stability. This is especially important for leaders in industries like healthcare or construction, where budget constraints are a constant.

By smoothing your income and maximizing deductions before year-end, you can:

This also helps manage risk, a top concern for many leaders, and keeps your team focused on what matters most—delivering results.

Forget the myth that your tax return meeting is the big one. The year-end tax planning session? That’s where the real magic happens. It’s not about delivering the tax return, reviewing financial statements or a mid-summer lunch catch-up. It’s the “here’s where we are and here are the options to change that” meeting. A smart CPA helps you make bold moves before the year closes, reducing taxable income and positioning your business for the year ahead.

The year-end tax planning meeting is your opportunity to review not just compliance but the financial health of your organization. Are you maximizing your resources in alignment with long-term goals? Are you prepared for future audits, or better yet, avoiding unnecessary risks? A proactive approach means you’re ready for anything. No last-minute scrambles.

Winning business owners and leaders know the game:

By getting ahead of your tax liabilities, you position yourself for long-term success. Knowing your tax situation lets you make better financial decisions.

Tax planning is more than just another item on your to-do list. It’s about fortifying your entire business strategy. A smart tax plan can shape your future—from expansion and investment to long-term legacy planning.

In industries like manufacturing and construction, where equipment depreciation and project costs need to be managed strategically, tax planning becomes your best ally in optimizing growth potential. It’s an essential tool to ensure every dollar invested has maximum impact on your mission.

Tax efficiency is your secret weapon in an unpredictable market. For organizations looking to grow, strategic planning and clear oversight from a trusted CPA provide the stability needed to weather economic shifts.

Not all CPAs are created equal. As SSC’s Reid Hash puts it:

“Most CPAs get nervous and are hesitant to do year-end tax planning meetings due to the risk of project results that may not be 100% perfect. You want a confident CPA who sees what’s on the books and what is going to occur before year-end to help predict future tax liability.”

Tax planning is about using knowledge to make the best decisions. Especially in industries like healthcare and government contracting, where compliance is non-negotiable, a proactive CPA can be the difference between smooth sailing and a financial crisis. The best CPAs provide actionable advice, helping you manage taxes, reduce risks and plan for long-term success.

While no one enjoys paying taxes, they’re a necessary part of doing business—and every small business needs profit to thrive. Effective tax planning, including income smoothing, helps maintain consistent taxable income, reducing your tax burden over time compared to the unpredictable fluctuations of spikes and dips.

Stop letting taxes control you. Take charge of your business’s financial future with SSC’s strategic tax planning. We’ll guide you through deductions, credits and deferrals, keeping you ahead of the curve. At SSC, we’re your trusted partner, anticipating needs, navigating regulations and optimizing your financial systems. Whether it’s tax prep, payroll or succession planning, we provide the clarity and expertise to help you plan for long-term success.

“SSC CPAs + Advisors” and “SSC” are the brand names under which SSC Advisors, Inc. and SSC CPAs, PA provide professional services. SSC Advisors, Inc. and SSC CPAs, PA practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. SSC CPAs, PA is a licensed independent CPA firm that provides attest services to its clients, and SSC Advisors, Inc. entities provide tax, advisory, and business consulting services to their clients. SSC Advisors, Inc. is not a licensed CPA firm. Our use of the terms “our firm” and “we” and “us” and terms of similar import, denote the alternative practice structure conducted by SSC Advisors, Inc. and SSC CPAs, PA. Advisory services provided through Wealthcare Advisory Partners, LLC doing business as SSC Wealth, LLC. Wealthcare Advisory Partners LLC is a registered investment advisor with the U.S. Securities and Exchange Commission.