Passing leadership to the next generation isn’t just an exit or you informally announcing, “Later, everyone. There’s a lounge chair on a beach I need to get to.” When done strategically, it can be a gift to your people, your clients, and the future of your business.

Business succession planning is the deliberate process of mapping how leadership, ownership, and critical knowledge transfer so the organization stays healthy, competitive, and true to its mission. By extension, this protects your organization’s value, preserves company culture, and gives owners control over timing and outcomes rather than leaving fate to chance.

To put that another way, if your organization and everything you’ve worked for is represented by a football, succession planning for business owners is what prevents you from fumbling it.

Let’s further explore this concept, and how it protects what you’ve built while giving yourself options for retirement, liquidity, or phased transitions.

Business succession planning is a strategic roadmap commonly used by business owners. At its core, the plan answers three questions:

The overall intent of business succession planning is practical and preventative. It aligns financial, legal, and operational steps so the transition is as predictable and tax‑efficient as possible. That includes valuing the business, identifying leadership gaps, creating compensation and retirement structures, and coordinating with lenders and legal advisors.

Succession planning also considers softer elements, such as communication with stakeholders, governance changes, and the emotional dynamics that often accompany handing over control. Pivotal transitions often result in a lot of feelings and side conversations that can distract your team, so it’s best to get ahead of that to guide the narrative.

As Brian Lang, CPA, CVA, Ceo of SSC CPAS + Advisors observes, “Succession planning is critical, but it’s not always easy. That’s where your advisor comes in. From initiating conversations to optimizing tax strategies and navigating family dynamics, a trusted advisor can guide you through the complexities of transitioning leadership or ownership.”

Although it may sound easier to bow out of the business game and let the remaining players take over, a thoughtful, measured approach to your exit yields some distinct benefits.

Business succession planning:

Each advantage translates into measurable outcomes, including shorter sales timelines, higher valuations, smoother lender negotiations, fewer operational lapses, and greater confidence for employees and customers.

Remember, it only took one iceberg to sink the Titanic. Business succession planning ensures you and everyone on your proverbial ship has a clear path forward.

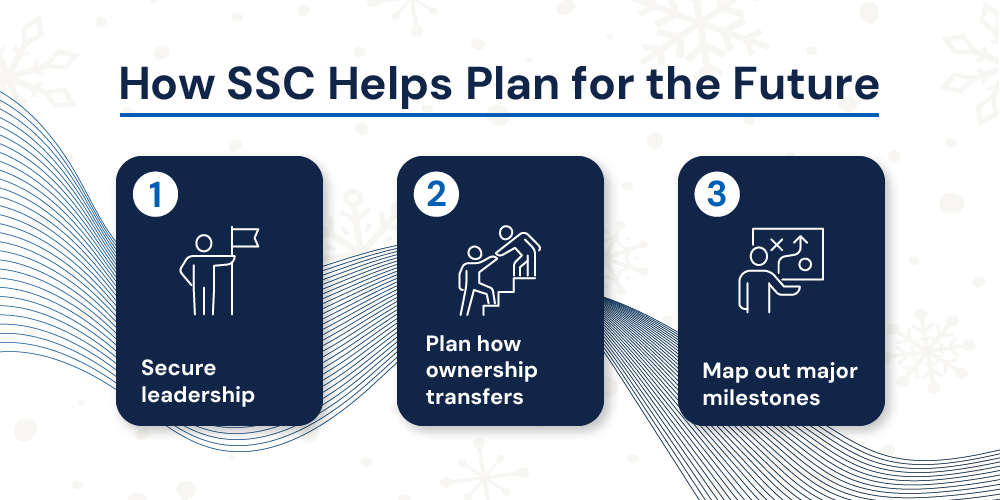

Starting succession planning doesn’t have to feel like assembling IKEA furniture with one hand tied behind your back. At SSC, we break the process into clear, manageable steps so owners move from uncertainty to a tailored plan without unnecessary stress.

The first step is a candid conversation. We ask about your personal goals, timeline, and what legacy means to you. Be as blunt as you want: we’ve heard it all and are ready to back your play.

From there, we perform a practical valuation and identify opportunities to increase value, whether that’s tightening financial reporting, improving margins, or addressing operational dependencies.

That assessment informs the recommended path: internal leadership development, an ESOP feasibility study, direct sale strategies, or hybrid approaches that phase ownership over time.

We coordinate the technical pieces — tax optimization, business valuation, contract and estate alignment, and lender conversations — so you don’t have to.

We also make sure the human side is handled thoughtfully: succession planning includes communication plans for employees, role definitions for successors, and transition timelines that reduce friction.

Our approach is consultative and well structured: we build a practical blueprint, test it against real scenarios, and adjust as business and family dynamics evolve. Succession planning for business owners becomes actionable with milestones like governance changes, funded retirement plans, or staged ownership transfers that protect cash flow and tax outcomes.

Working with SSC means we don’t just tell you what could happen like some $5 fortune teller; we actively help make it happen. We keep the process approachable, translate complex tax and valuation issues into clear choices, and empower you to act with confidence.

Remember: the best time to build a succession plan is when you still have options. If you wait until an emergency, choices narrow and outcomes get dictated by circumstances, not by strategy.

Business succession planning is the ultimate present to your organization because it converts uncertainty into a future you control. It’s about protecting value, honoring your people, and choosing how your life’s work endures.

If you’re ready to protect your legacy and explore options, SSC is ready when you are. We help business owners build financial management systems that scale and craft succession plans that balance tax, liquidity, and culture.

Reach out to initiate the conversation. Together, we’ll design a plan that fits your goals and keeps the business thriving for years to come.

“SSC CPAs + Advisors” and “SSC” are the brand names under which SSC Advisors, Inc. and SSC CPAs, PA provide professional services. SSC Advisors, Inc. and SSC CPAs, PA practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. SSC CPAs, PA is a licensed independent CPA firm that provides attest services to its clients, and SSC Advisors, Inc. entities provide tax, advisory, and business consulting services to their clients. SSC Advisors, Inc. is not a licensed CPA firm. Our use of the terms “our firm” and “we” and “us” and terms of similar import, denote the alternative practice structure conducted by SSC Advisors, Inc. and SSC CPAs, PA. Advisory services provided through Wealthcare Advisory Partners, LLC doing business as SSC Wealth, LLC. Wealthcare Advisory Partners LLC is a registered investment advisor with the U.S. Securities and Exchange Commission.