“I need more hours in the day.”

If you’re a business owner or CFO, you’ve probably said this once—or a hundred times. Between managing cash flow, approving expenses, reviewing financials, and putting out fires, finance can feel like a full-time job…on top of your full-time job.

But what if your financial operations could run in the background, accurately, reliably, and with fewer headaches?

That’s exactly what automated finances offer. By building a financial engine that operates seamlessly, you can reduce risk, improve decision-making, and free up time to focus on what actually matters: leading your business forward.

Here’s how we help clients create a financial system that runs on autopilot—without losing control.

Not every task should be automated—but many can. The key is knowing what to automate and why—and what still needs a human touch.

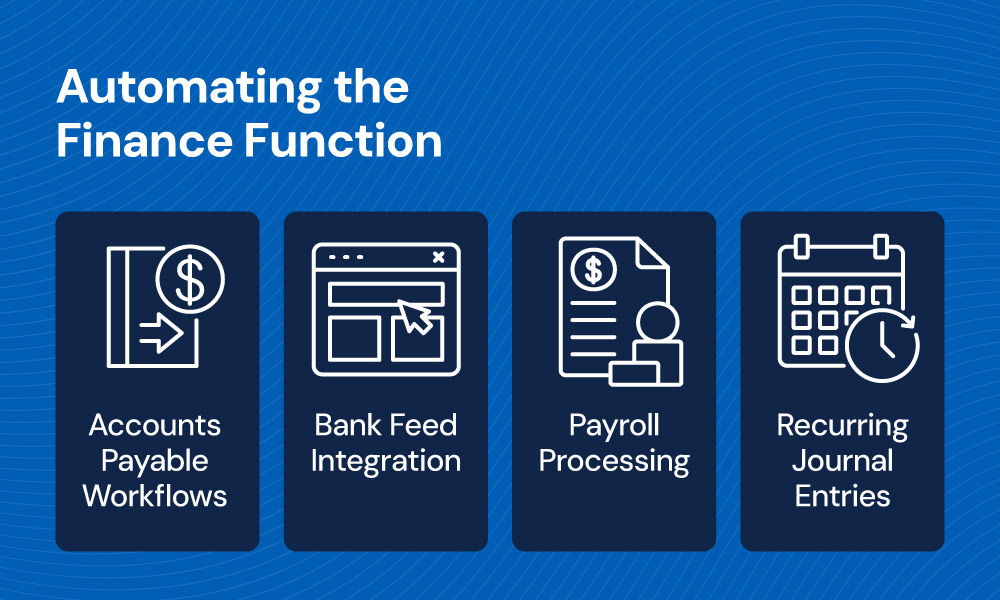

At SSC, we often begin by helping clients identify and implement automation for the high-volume, high-repetition tasks that bog teams down and increase the risk of error. Some of the most impactful starting points include:

With these foundational automations in place, teams can close the books faster, reduce manual errors, and spend less time on repetitive tasks—unlocking more time for strategy and growth.

Disconnected systems create friction. If you’re toggling between software platforms, juggling spreadsheets, or manually exporting reports, you’re wasting time and risking errors.

The goal is an integrated financial tech stack that connects the dots between your core functions. This typically includes:

When your systems talk to each other, data flows automatically, and your reporting becomes more timely, accurate, and actionable. This kind of integration supports smarter financial management and gives your team confidence in the numbers they see.

Automation isn’t just about doing things faster—it’s about knowing what’s happening right now, what should occur in the future, and not the last quarter. We use operational information, like sales orders and backlog schedules, to forecast the impact on your financials.

Through our Client Accounting Services, we help clients create custom dashboards that display:

These real-time insights can dramatically improve decision-making. Instead of relying on lagging indicators, you can proactively respond to opportunities and challenges. This is where automated financial management becomes a true strategic asset, not just a back-office upgrade.

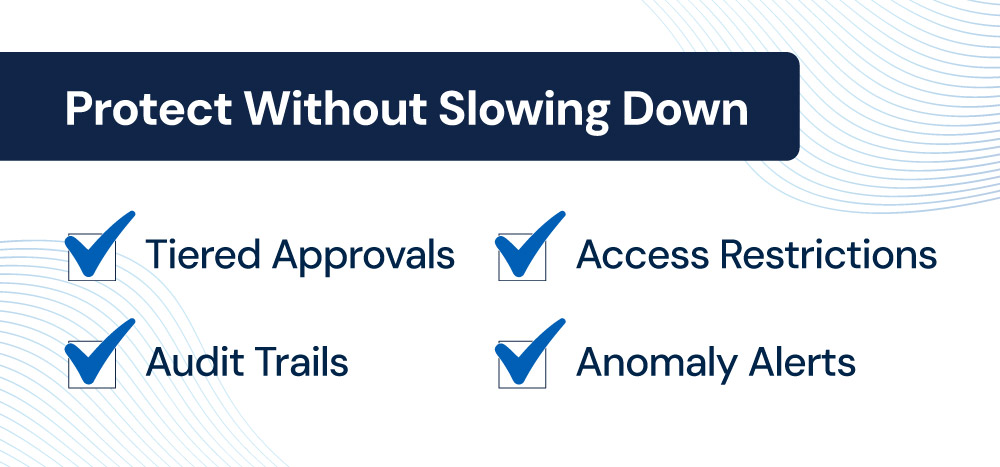

Growth creates complexity—and with complexity comes risk. Automation can help scale your business without slowing it down.

Here are some examples of digital internal controls we help clients implement:

These internal safeguards are especially important for CPA services for small business clients who may not have full-time compliance or audit teams. Smart automation keeps your financials clean, your team accountable, and your business better prepared for audits or future transitions—like mergers, acquisitions, or succession planning for business owners.

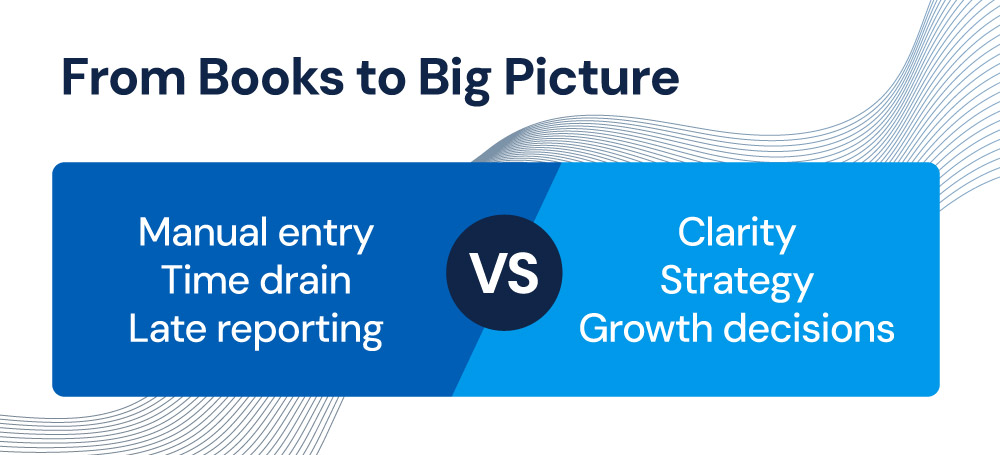

The greatest benefit of a well-designed financial system? You get your time back.

Instead of scrambling to close the books or chase down receipts, you and your team can spend more time on strategy:

When your back office runs on automated finances, you gain the clarity and capacity to make forward-thinking decisions. You’re no longer just reacting—you’re leading proactively, backed by data and confidence.

We don’t just offer accounting—we build better financial engines.

Our team combines deep accounting expertise with technology-forward solutions designed to simplify your operations, improve accuracy, and free you up to focus on the bigger picture.

We specialize in CPA services for small business clients who want more than just tax prep at year-end. Our advisory-led approach gives you the insight and structure you need to grow confidently, avoid costly mistakes, and build lasting value.

Whether you’re looking to clean up your books, reduce risk, or start thinking about the future of your business, our team is here to help.

Let’s talk about what’s slowing you down—and what you could be doing with more time and better data.

At SSC CPAs + Advisors, we help business owners build financial management systems that scale, so you can lead with clarity and confidence. We’re ready when you are.

“SSC CPAs + Advisors” and “SSC” are the brand names under which SSC Advisors, Inc. and SSC CPAs, PA provide professional services. SSC Advisors, Inc. and SSC CPAs, PA practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. SSC CPAs, PA is a licensed independent CPA firm that provides attest services to its clients, and SSC Advisors, Inc. entities provide tax, advisory, and business consulting services to their clients. SSC Advisors, Inc. is not a licensed CPA firm. Our use of the terms “our firm” and “we” and “us” and terms of similar import, denote the alternative practice structure conducted by SSC Advisors, Inc. and SSC CPAs, PA. Advisory services provided through Wealthcare Advisory Partners, LLC doing business as SSC Wealth, LLC. Wealthcare Advisory Partners LLC is a registered investment advisor with the U.S. Securities and Exchange Commission.